The global healthcare software market is experiencing unprecedented growth, driven by digital transformation, increasing healthcare demands, and technology adoption. This analysis explores regional opportunities and trends for 2026.

Global Market Overview

The healthcare IT market is projected to reach $974.5 billion by 2027, growing at a CAGR of 13.8%. Key drivers include:

- Digital health adoption post-pandemic

- Government healthcare digitization initiatives

- Rising chronic disease prevalence

- Telemedicine normalization

- AI and analytics integration

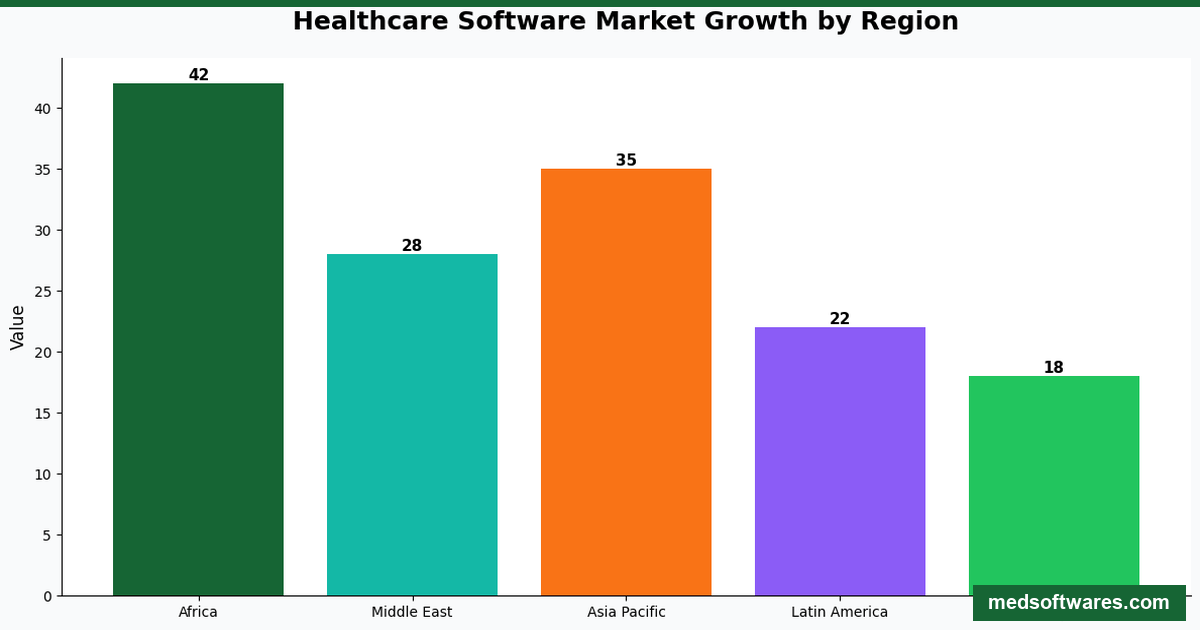

Regional Analysis

Africa: 42% Growth Rate

Africa represents the fastest-growing healthcare software market, driven by:

Key Drivers:

- Mobile-first healthcare adoption

- Government digitization programs (Ghana's e-Health, Kenya's UHC)

- Expanding private healthcare sector

- International development funding

- Youth population growth

Market Characteristics:

- Strong preference for offline-capable solutions

- Mobile money payment integration essential

- One-time pricing preferred over subscriptions

- Local language support important (French, Arabic, Swahili)

- NHIS/NHIF integration requirements

Top Markets:

- Nigeria: 200+ million population, rapidly expanding private sector

- Kenya: East Africa's tech hub, strong mobile money ecosystem

- Ghana: Progressive e-Health policies, NHIS nationwide

- South Africa: Most developed healthcare infrastructure

- Ethiopia: 120+ million population, government investment

MedSoftwares in Africa: We serve pharmacies and hospitals across 15+ African countries with PharmaPOS and HospitalOS, featuring offline mode, mobile money, and NHIS integration.

Asia Pacific: 35% Growth Rate

Asia Pacific combines mature markets (Japan, Australia) with high-growth emerging markets:

Key Drivers:

- Massive population (4.7 billion)

- Rising middle class healthcare spending

- Government smart hospital initiatives

- Medical tourism growth

- Telemedicine adoption

Market Segments:

- Developed (Japan, Australia, Singapore): Advanced EMR, AI integration, IoT

- Emerging (India, Philippines, Indonesia): Basic digitization, affordable solutions

- High Growth (Vietnam, Thailand, Malaysia): Rapid modernization

Top Emerging Markets:

- India: 1.4 billion population, Ayushman Bharat driving digitization

- Philippines: 7,000+ islands need distributed healthcare solutions

- Indonesia: 270+ million population, archipelago logistics challenges

- Bangladesh: 170+ million, growing private healthcare

- Vietnam: Rapid economic growth driving healthcare investment

Middle East: 28% Growth Rate

Oil wealth and vision programs drive healthcare technology adoption:

Key Drivers:

- Saudi Vision 2030, UAE diversification

- Medical tourism investment

- Smart city healthcare initiatives

- High per-capita healthcare spending

- International accreditation requirements

Market Characteristics:

- Premium positioning acceptable

- Arabic language support essential

- Integration with insurance systems

- High quality expectations

- Government procurement processes

Top Markets:

- UAE: Dubai and Abu Dhabi medical hubs

- Saudi Arabia: Largest regional market, Vision 2030

- Qatar: FIFA legacy healthcare investment

- Kuwait: High healthcare per capita spending

- Oman: Expanding private healthcare

Latin America: 22% Growth Rate

Digital transformation accelerating across the region:

Key Drivers:

- Public health system modernization

- Private healthcare expansion

- Telemedicine regulation enabling

- Medical tourism (Mexico, Brazil, Colombia)

- Pan-American Health Organization initiatives

Market Characteristics:

- Spanish and Portuguese language essential

- Price sensitivity in many markets

- Integration with public health systems

- Multi-country regional presence valuable

- Hybrid public-private models

Top Markets:

- Brazil: Largest regional market, SUS digitization

- Mexico: Proximity to US, medical tourism

- Colombia: Healthcare reform driving technology

- Argentina: Economic challenges but strong infrastructure

- Chile: Most digitally advanced in region

Europe: 18% Growth Rate

Mature market with steady, regulated growth:

Key Drivers:

- GDPR and regulatory compliance

- NHS and public health digitization

- Aging population demands

- Interoperability requirements

- AI and analytics adoption

Market Characteristics:

- High compliance requirements

- Integration with national health systems

- Multi-language support needed

- Premium pricing acceptable for quality

- Long procurement cycles

Where the Opportunities Are

Underserved Market Segments

- Small-Medium Hospitals (50-200 beds): Too small for enterprise solutions, need affordable alternatives

- Rural Healthcare: Connectivity challenges require offline solutions

- Community Pharmacies: Mom-and-pop pharmacies need affordable, simple tools

- Clinic Chains: Growing segment needing multi-location management

Technology Gaps

- Offline Capability: Most solutions assume reliable internet

- Mobile Payments: Local payment methods often unsupported

- Affordable Pricing: Enterprise solutions priced for wealthy markets

- Local Insurance: National schemes often not integrated

How MedSoftwares Addresses These Gaps

For Pharmacies: PharmaPOS

- Offline Mode: Works without internet

- Mobile Money: MTN, M-Pesa, Vodafone built-in

- One-Time Pricing: $299-$899, no subscriptions

- NHIS/NHIF: Local insurance integrated

- Multi-Language: English, French, Arabic

For Hospitals: HospitalOS

- 25+ Modules: Complete hospital management

- Offline Capable: Core functions work offline

- Affordable: $799-$2,999 one-time

- Local Insurance: NHIS, NHIF, private insurers

- Telemedicine: Built-in video consultations

Regional Expansion Strategy

MedSoftwares is expanding across high-growth regions:

Current Presence (25+ countries):

- Africa: Ghana, Nigeria, Kenya, South Africa, Tanzania, Uganda, Rwanda, Cameroon, Senegal, Ethiopia

- Middle East: UAE, Saudi Arabia, Qatar

- Asia: India, Philippines, Bangladesh, Malaysia

- Latin America: Mexico, Brazil, Colombia

2026 Focus:

- Francophone Africa expansion

- Southeast Asia growth

- Latin America deepening

- Middle East partnerships

Conclusion

The healthcare software market presents significant opportunities, particularly in emerging markets where:

- Internet reliability is challenging

- Mobile payments are dominant

- Affordable pricing is essential

- Local integrations are required

MedSoftwares is positioned to capture this growth with purpose-built solutions for these markets.

Contact us to discuss opportunities in your region.

![NHIS and NHIF Integration: Complete Healthcare Software Guide [2026]](/_next/image?url=%2Finfographics%2Fnhis-nhif-integration-stats.png&w=2048&q=75)